Guide to Company Incorporation in the UK 2024

- Modified: 24 October 2023

- 6 min read

- Starting a Company

Jon Mills

Business Writer

Jon relishes writing content that both educates and entertains the reader. With a background in copy and content writing for brands, he's told unique stories in creative ways, adding value to products in the luxury sector. Now, he works with our accounting experts and small business owners to bring their advice and journeys to life for Osome's readers. He aims to inspire ambitious entrepreneurs to set their sights high, and build highly-respected, flourishing businesses.

Company incorporation is perhaps the most exciting part of any entrepreneurial journey. This is where it starts. You've got an idea, a product, a dream – but first, you need to do the paperwork.

What Is Company Incorporation?

Company incorporation is when a new (or existing) business registers as a limited company.

A limited company is a helpful structure for entrepreneurs since it’s entirely separate from you. Your risk is — as the name suggests — limited. Any debt, losses, or legal claims associated with your company are not your responsibility. The company is a distinct legal entity. A ’person’ in its own right.

Many people in the UK, by comparison, are sole traders. This means the company and the owners are the same. A limited company clearly demarcates the person and their business.

This is a great benefit — but it’s more admin. Like anything in life, it’s a trade-off. But one that’s worth making if you’re serious about growing your business long-term.

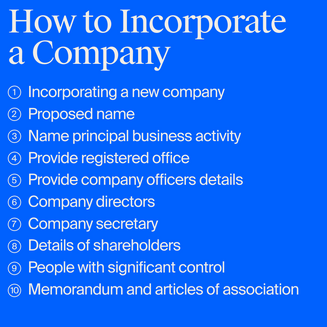

How To Incorporate a Company

Right, so you’ve decided that a limited company is the right corporate structure for you. It's one of the most popular business structures for a reason.

One big advantage is that it clearly separates your personal finances and your business. In essence, your company becomes a separate legal entity, which means if things go south financially, your personal assets are typically protected. That provides huge peace of mind. You’ll look more professional in the eyes of customers, suppliers, and investors. When you see "Ltd" or "Limited" at the end of a company name, it gives off an air of stability and credibility.

Long term, it’s a good move (in our humble opinion)! But there are a few things you need to determine and sort out beforehand.

Here’s what you need to form a company:

Incorporating a new company

In simple terms, incorporating a company is the process of registering your business as a limited company with Companies House. Companies House is the UK Government’s official registrar of companies.

By incorporating a company, you create a distinct legal identity. That is, you and your business are, essentially, separate ‘people’. If things don’t go to plan, you are protected from the liabilities incurred.

Proposed name

Your business needs a name, doesn’t it? Decide on a name that really captures the essence of your business. Be literal or a bit more metaphorical.

Just remember, there are a few restrictions. Any company name that suggests a link to an official body, the monarchy, or a charity cause must be approved beforehand. Obviously, any naughty words or hate speech are forbidden.

Name principal business activity

To identify what your principal business activity is, Companies House use what’s known as a SIC code, or Standard Industrial Classification code. This is a unique sequence of five numbers representing a specific economic activity.

When you register your business, you must provide at least one SIC code to describe the type of trade carried out by your company. If your business is varied or complex, you can use up to four SIC codes.

Provide registered office

Your business needs an official HQ. This can be anywhere in your chosen jurisdiction (England and Wales, Scotland or Northern Ireland). But it must be a physical, occupied building. A PO box is not suitable.

Note, however, that this address is not necessarily where you work. It can, for instance, be your adviser's or accountant's address.

Provide company officers details

The government defines an «officer» of a company as a director, manager or (company) secretary. These are the people who run or own the company.

Companies House needs to know the details of these people. And if things change down the line, you can alter your details with Companies House.

Company directors

While your company is its own separate legal entity, it does need at least one human face. This person is known as a company director. As you may suspect, the director is responsible for managing your business.

There must be at least one director, but your business may also have several directors. The directors can also be foreigners or based overseas.

Company secretary

A company secretary’s primary role is to keep your company compliant with the law. In the past, you needed a specific company secretary to incorporate. Today that isn’t necessary — any director can assume this role.

However, many businesses still like to appoint a specific secretary. This is done to lighten the directors' admin workload and keep the business compliant.

Details of shareholders

This is the owner (or owners) of your business. It differs from a director (since a director is not necessarily a shareholder and vice versa). You can, however, be a shareholder and a director simultaneously.

Before incorporating your business, you need to discern what shareholders there are.

People with significant control

A person with significant control (PSC) is a person who owns or controls your company. A frequent term for a PSC is a ‘beneficial owner’.

When you incorporate, you must let Companies House know who your PSCs are. If this changes, you must let Companies House know.

Memorandum and articles of association

These are the ground rules of your business. It sets out roles and responsibilities, how directors are appointed or removed, and how meetings will be held and recorded.

It’s an important foundation for your limited company. Not just legally, but in general. The UK government actually has model articles you can use. If you need something more bespoke, speak to an adviser.

Documents Required for the Incorporation of a Company

Application to register a company (form IN01)

This form is sent to Companies House — the statutory body in the UK that incorporates businesses. The form should be sent alongside the appropriate fee. The standard fee for electronic filing is £12 (and £27 for community interest companies).

Memorandum of association

A legal document signed by directors, shareholders and guarantors formally agreeing to the articles of association. Companies House will generate this for you.

Articles of association

The constitution of your business. This document outlines the roles and responsibilities of your company directors and shareholders and how daily affairs will be conducted. You can also simply adopt model articles (provided by the government) in their entirety.

Additional information

If your application includes a sensitive word or expression, the government must first approve it. There is a list of these terms on .gov. Usually, it’s if your name suggests some sort of official or charity connotation.

Advantages and Disadvantages of Incorporating a Company

Incorporating a company in the UK can offer several advantages but also some potential drawbacks. Here is a summary of the pros and cons:

Pros of incorporation

- Limited liability protection: One of the biggest advantages of incorporating a company is that it provides limited liability protection for its directors and shareholders. This means that if the company goes bankrupt or is sued, the personal assets of the directors and shareholders are generally protected.

- Credibility and trust: Incorporating a company can enhance credibility and trust among customers, suppliers, and partners. A registered company is considered more established and professional than an unincorporated business.

- Access to investment opportunities: A registered company can issue shares, allowing for more flexible equity ownership than unincorporated businesses. This can make it easier to raise capital from investors.

- Tax benefits and incentives: Companies in the UK pay corporation tax on their profits, which is currently 19%. This is lower than the income tax rate individuals pay on their earnings. Many tax benefits and incentives are also available to companies, such as research and development tax credits and capital allowances.

Cons of incorporation

- Administrative responsibilities: Incorporating a company involves complying with various legal and regulatory requirements, such as filing annual accounts and tax returns. This can result in increased administrative burdens for directors.

- Set-up and maintenance costs: There are costs associated with incorporating and maintaining a company, such as registration and annual filing fees.

- Public disclosure requirements: Information about registered companies is publicly available on the Companies House website. This includes information about the company's directors, shareholders, and financial performance.

- Additional tax burden: In some cases, incorporating a company can lead to an additional tax burden. For example, if a company distributes dividends to its shareholders, they will have to pay income tax.

Overall, whether or not to incorporate a company in the UK will depend on the specific circumstances of the business and the owners' goals. Incorporating may be a good option for businesses looking for limited liability protection, credibility, and access to investment opportunities. However, businesses should carefully consider the administrative responsibilities and costs involved before making a decision.

Additional factors to consider

- The size and complexity of the business: Larger and more complex businesses are more likely to benefit from the advantages of incorporation.

- The industry in which the business operates: Some industries, such as financial services and healthcare, have specific regulatory requirements for incorporated businesses.

- The owners' personal circumstances: Business owners with significant personal assets may want to consider incorporation to protect their assets from business liabilities.

If you're thinking about starting a company in the UK, it's a good idea to chat with an accountant or solicitor so you can get a clear picture of what's involved and choose the right business structure.

FAQ

How to incorporate a private limited company?

To incorporate a company in the United Kingdom, you must start an application with Companies House. Companies House is the official registrar of companies, appointed by the UK government. This body is the sole registrar in the UK. No other organisation can register a business in the UK.

If a company is incorporated what does it mean?

To be 'incorporated' means Companies House has your business on its records. When your limited company is registered, this creates a legal entity that is separate from you. Meaning that you are protected - as a private individual - if things don't work out.

What is the difference between corporation and incorporation company?

Think of it this way: Corporation is a noun, and incorporation is a verb. Incorporation is the actual process of setting up a limited company. A corporation is a more loosely defined way to identify an incorporated entity. Usually, it designates a big company.

How to check the status of company incorporation?

It's all online! You can find the details of a business's status via the Companies House website. You can get details on a company's: registered address, current and resigned officers, previous names and trade status. You can also set up email alerts for when anything changes.

How to find out where a company is incorporated?

Check on Companies House's web portal. Type in a company's name or, if you know it, a director's name and hit search. The web portal will give you information on a registered address. Whichever country that address is in, is where the company is registered.

How to find the date of incorporation of a company?

Again, look online. Companies House web portal will offer the answers you're seeking. Among lots of other details, the web portal will show you the who, what, where and when of any incorporated UK companies. If it's on the Companies House website, you know it's accurate.

How to get a company certificate of incorporation?

Companies House will send your certificate of incorporation to you. This is done once your business is successfully registered. This document contains your company's vital information, including your company's full name and your unique registration number. Keep it for your records!

How many shares should a startup company authorize at incorporation?

There's no 'right' answer here. You need to issue at least one share. And there is no limit to how many shares you can issue and the number of shareholders you can have. Just be conscious to not dilute the ownership of your business too much.

When should you form a business?

Deciding when to start a business is a big deal and it depends on a lot of factors like your business idea, goals, and personal situation. The right time to start your business might be different from someone else's. So, it's important to research, plan carefully, and weigh the pros and cons before diving into entrepreneurship. Starting a business is a huge commitment, so it's a good idea to take your time and make a thoughtful decision that aligns with your goals and situation.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?