How To Find and View Your VAT Certificate Online

Struggling to find and view your VAT certificate online? This comprehensive guide will lead you through the process of accessing your VAT certificate, understanding its importance, and maintaining its validity. Equip yourself to handle your VAT obligations efficiently and legally.

Running a registered company or a self-employed venture and wondering how to access your VAT certificate online? Or unsure if you need to register for VAT?

Getting to grips with VAT certificates is crucial for your business. Luckily, it’s quite handy that you can access them online now.

What Is a Company’s VAT Certificate?

A VAT certificate is a must-have document for every registered company, and your ticket to legally collecting Value Added Tax (VAT) on sales. Issued by your country's tax authorities, it includes vital details like your VAT registration number, company trading name, and address.

A VAT certificate is your go-to for selling VAT-subject goods or services too. It's a legal necessity if your annual sales cross a certain limit. For instance, in the UK, if your annual taxable turnover goes beyond £90,000, you've got to register for VAT.

Getting your hands on a VAT certificate is pretty easy fortunately. Register for VAT with HMRC, then send an email to vat66@hmrc.gov.uk with ‘VAT certificate of status request’ as the subject line of your emai, and the following information:

- The name of the business;

- The VAT registration number of the business;

- The business address;

- Your name and role in the business (for example sole trader, partner, trustee, director or company secretary);

- Your contact telephone number;

- Attach your completed ‘informed consent’ form to your email.

You’ll then be sent your company’s VAT certificate. It's not a trading licence, but confirmation that you're VAT-registered and can charge VAT on sales. To operate legally, you'll still need to tick other regulatory boxes.

Remember, keeping your VAT certificate updated is key. If your company's details change, like your address or turnover, you must notify HMCR and refresh your VAT certificate.

In a nutshell, a VAT certificate is a non-negotiable for every registered company with annual taxable turnover exceeding £90,000.

The Importance of a VAT Certificate for Registered Companies

A VAT certificate is your business's legal proof of VAT registration and authorisation to charge VAT.

When a company is VAT-registered, it indicates it has passed the government's VAT registration criteria. Once registered, you need to add VAT to your sales and regularly report VAT returns to HM Revenue and Customs (HMRC).

A valid VAT certificate is a non-negotiable. Without it, you risk penalties or even losing your VAT registration. HMRC aren’t ones to mess around, and businesses that neglect VAT registration or incorrectly charge VAT face heavy fines. In extreme cases, penalties can equal 100% of the VAT due. So, keeping your VAT certificate valid and complying with all regulations is crucial.

A VAT certificate also boosts your business credibility. A VAT-registered company is viewed as legitimate, trustworthy, and financially stable, attracting customers and suppliers. It signals that you operate within the law, maintain accurate records, and regularly submit VAT returns to HMRC.

Do I Need To Register for VAT as a Self-Employed Entrepreneur?

As a self-employed entrepreneur, you might be questioning whether you need to register for VAT. Understanding whether you should register can be tricky, but it's crucial to your business operations.

Your need to register for VAT hinges on factors like your turnover and the nature of your goods or services.

However, some exceptions exist. Selling VAT-exempt goods or services, such as education, healthcare, or financial services, might mean you don't need to register. But if your offerings are VAT-liable and you exceed the turnover threshold, registration is typically necessary.

To VAT, or not to VAT? That is the question…

If you have questions about VAT registration, why not have a chat with one of Osome’s expert accountants? They'll clarify your unique VAT obligations and guide you through the registration process.

How To Register for a VAT Certificate Online

Need to register for a VAT certificate in the UK? Good news — you can do it all online. No more traipsing to government offices — just a few clicks and you're on your way.

First up, know what type of VAT certificate you need. Generally, there are two types – a standard VAT certificate for businesses selling goods or services at the standard VAT rate, and a reduced rate VAT certificate for businesses selling certain items like specific food or medical supplies at a lower VAT rate.

Once you've identified your VAT certificate type, it's time to gather necessary information about your company. This includes your company's name, address, and VAT registration number (if you have one). You might also need details about your directors or shareholders.

Now, it's time for the online application process. Create an account on the Government Gateway and fill out the online application form with your company's information and the VAT certificate type you need.

After hitting the 'submit' button, your application heads to the VAT department for review, typically taking a few weeks. If your application checks out, you'll receive your VAT certificate by email. If you prefer to do things the old fashioned way, you can always register for VAT by post.

But remember, once you have that VAT certificate, you need to start charging VAT on your goods or services. Regular VAT returns are also mandatory, indicating how much VAT you've charged and paid.

When Will My VAT Certificate Be Available?

Typically, you can expect your VAT certificate to appear on the HM Revenue and Customs (HMRC) portal within a few weeks of your registration.

Getting a VAT certificate sometimes needs substantial documentation, such as financial statements and tax returns. However, in some instances, the process is straightforward with less paperwork involved.

It's essential to familiarise yourself with the UK's specific VAT regulations. Having a solid understanding of these rules will help you to navigate the process smoothly and ensure you remain compliant with tax laws.

How To View Your VAT Certificate

One of the key steps once you're registered is knowing how to view your VAT certificate. Follow these simple steps — from logging into the Government Gatewayportal to saving or printing your VAT certificate:

Log In to the Government Portal

Start by heading to the UK Government's official portal — the HM Revenue and Customs (HMRC) online services. If you're already registered, you can log in using your Government Gateway user ID and password. If you're not registered yet, you'll need to sign up for an account first.

Select “View Your Account”

Once you've logged in, navigate to the 'Your Account' section. Here, you'll find an overview of your tax information. Remember, this portal isn't just for VAT; it's for all your tax affairs.

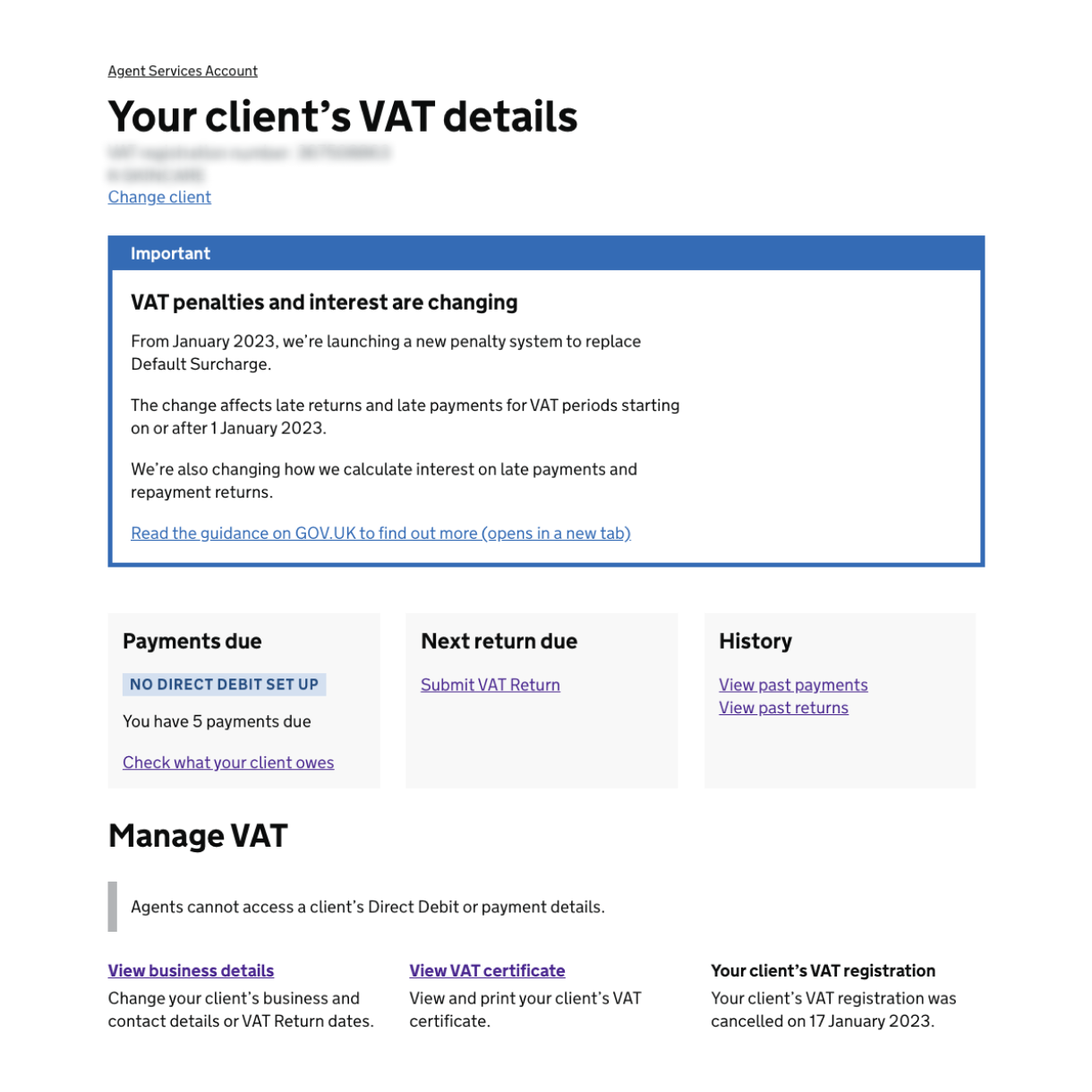

Select “View Your Certificate”

From 'Your Account', go to the 'VAT Account' section. Here, you'll find an option to 'View VAT Certificate.' Clicking this will bring up your current VAT certificate, complete with all the relevant details like your VAT registration number and the date you became eligible for VAT.

View, Save or Print Your VAT Certificate

Once your VAT certificate is displayed, you can view all the details to ensure they're correct. It's also a good idea to save a digital copy for your records. Simply click 'Download' or 'Print,' depending on whether you want to store a digital copy or need a hard copy. Remember, it's important to keep this certificate accessible, as you may need it for financial documentation or if HMRC requests it.

Easy as VAT

Now, accessing your VAT certificate should be simple. But, to make it simpler still, leave it to Osome. We’re experts in VAT for ecommerce and >VAT for Amazon sellers, too.

FAQs

What should I do if my VAT certificate is unavailable online?

If you can't find your VAT certificate on the HM Revenue and Customs (HMRC) portal, don't worry. There might be a technical issue or a delay in processing your VAT registration. Reach out to HMRC for help.

A technical glitch could be the culprit. If you suspect so, try accessing your certificate later or on another device. If the issue persists, contact HMRC.

Recently registered for VAT? It can take up to 30 days for your certificate to appear online. If it's been over a month and you still can't access it, check with HMRC.

Changes in your VAT registration details could also affect the certificate's online availability. Contact HMRC to ensure your updated details are correctly reflected.

Remember, your VAT certificate is vital for your business operations within the UK and the EU. If you can't access it, reach out to HMRC to get it sorted.