Understanding the UK EU Trade for Entrepreneurs from the UK

- Modified: 19 October 2023

- 5 min read

- Tax & VAT

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

If you're looking to restart your business in Europe post-Brexit, it's essential to understand the ins and outs of UK EU trade. Trade regulations and procedures have significantly changed with the UK's departure from the European Union. But fear not! By grasping the changes that have come with the UK’s trade with the EU, you'll be well-equipped to plan your next move strategically.

How EU VAT Registration Works?

If you trade from the UK to the EU, you don’t usually need to charge VAT to your customers. Just make sure you’ve completed your VAT registration with HMRC.

Choose the County Where You Need To Trade

If you’re getting ready to trade in the EU as a UK business owner after Brexit, the country you choose means considering a few key factors. Start by researching market demand, competition, and cultural compatibility. Look into trade agreements and regulations specific to each country. Think about logistics and transportation costs. And don't forget to assess language barriers and customer preferences. By doing your homework and finding the best fit, you'll set yourself up for success across borders.

Plan to trade in one country outside the UK or twenty? We’ll take care of them all with our streamlined accounting services.

Fill In the Required Forms

In preparing to trade between the UK and the EU, you must complete all the required forms. We’ll send you the list of all the documents we need to help you do this. We’ll then collect them from you online and prepare your applications.

Register for VAT

Registering for VAT is easy, but it’s easier if you let us do it for you with our bookkeeping services. We send you the VAT registration documents and advise on reporting before you start your UK-EU trade journey.

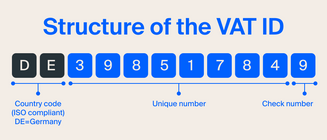

What Is the EU VAT Number?

A VAT number – or VAT registration number – is a unique code issued to companies that are registered to pay VAT. It acts as an identifier used in many countries, including countries in the European Union. It’s used for tax purposes. In the EU, a VAT number can be verified online at the EU’s VIES (VAT Information Exchange System), a search engine owned by the European Commission.

How To Get an EU VAT Number?

To get an EU VAT number, your company needs to register for VAT in the EU, and you need to apply to Her Majesty Revenue & Customs (HMRC). You can either register yourself via the VAT online service or get an accountant or agent to do this for you.

After registering, you will get a VAT registration certificate within 2-8 weeks. The tax authorities may well ask further questions, specifically to try to prevent VAT fraud. Once your company has received your VAT number, you are free to start trading and charging VAT on foreign transactions. Keep in mind to follow the rules on EU VAT Compliance and complete regular EU VAT Returns.

How To Check an EU VAT Number?

You may find yourself wanting to check the VAT number of a company you want to do business with. You may want to check if their VAT registration number is valid, or you may just want to check the company name and address of the business the number is registered to.

You can check the VAT number of a company in the EU using the VIES system. If you’re looking to check the UK VAT number, you can check it here.

What Is EU VAT Identification Number?

An EU VAT Identification Number or VAT registration number is a unique number that identifies a taxable business registered for VAT. Companies can find these numbers on the registration certificate issued by HMRC, and it should be stated on any invoice they give.

Every EU country issues its own national VAT number. If your business supplies goods or services in several EU countries, you might need to get a VAT number in each of these countries.

Benefits of Trading in the EU From the UK With Osome

EU Tax Representatives

We have accountants across all of Europe to take care of your tax related issues, handle communication with the authorities, and ensure the highest quality standards.

Zero Paperwork

Automate filings with our software and get informed when a deadline is soon to come or when a payment is due. We check all information for accuracy, so you always receive notifications whenever there are any payments to make, things to consider or deadlines to meet.

Sensible Prices

Cost effective solution to scale your business on post-Brexit time. The exact price depends on many factors, but we’ll find the best option for your business.

When You Need To Register for an EU VAT Number

These are the most frequent but not the only reasons to pay VAT in other countries.

Talk to our experts about your case and find out what to expect.

Goods Storage in the EU

As a UK business owner looking to trade in the EU, storing your goods in one or several countries can be a smart move to expand your operations. However, storage in any EU country means you must register for VAT there. Make sure you organise your storage in a way that minimises VAT expenses.

Buying and Selling Goods in the EU

When venturing into buying and selling goods in the EU as a UK business owner, keeping VAT regulations in mind is essential. Each country has unique VAT rules, so ensure you understand them. Whether you're buying or selling, it's crucial to register for VAT in the respective country. This ensures compliance with local tax laws and avoids any potential issues.

Hosting Events in the EU

If you’re a UK business looking to host an event in an EU country, clarify your intent with the event. You must be VAT-registered if you collect money for participating in the event, like a training session or a music festival.

The VAT Registration Threshold

When trading in the EU as a UK business owner, knowing the VAT registration threshold is crucial. Each country has its own threshold, determining whether you must register for VAT. If your sales or services to a particular country exceed its VAT delivery threshold, you are required to register for VAT in that specific country. It's important to monitor your sales carefully and keep track of each country's threshold to ensure compliance.

FAQ

What is the EU VAT number?

A VAT number – or VAT registration number – is a unique code issued to companies that are registered to pay VAT. It acts as an identifier used in many countries, including countries in the European Union. It’s used for tax purposes. In the EU, a VAT number can be verified online at the EU’s VIES (VAT Information Exchange System), a search engine owned by the European Commission.

How to get an EU VAT number?

To get an EU VAT number, your company needs to register for VAT in the EU, and you need to apply to Her Majesty Revenue & Customs (HMRC). You can either register yourself via the VAT online service or get an accountant or agent to do this for you.

After registering, you will get a VAT registration certificate within 2-8 weeks. The tax authorities may well ask further questions, specifically to try to prevent VAT fraud. Once your company has received your VAT number, you are free to start trading and charging VAT on foreign transactions. Keep in mind to follow the rules on EU VAT Compliance and complete regular EU VAT Returns.

How to check an EU VAT number?

You may find yourself wanting to check the VAT number of a company you want to do business with. You may want to check if their VAT registration number is valid, or you may just want to check the company name and address of the business the number is registered to.

You can check the VAT number of a company in the EU using the VIES system. If you’re looking to check the UK VAT number, you can check it here.

What is EU VAT identification number?

An EU VAT Identification Number or VAT registration number is a unique number that identifies a taxable business registered for VAT. Companies can find these numbers on the registration certificate issued by HMRC, and it should be stated on any invoice they give.

Every EU country issues its own national VAT number. If your business supplies goods or services in several EU countries, you might need to get a VAT number in each of these countries.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?