Tax on Rental Income - A Guide for Landlords

- Published: 4 March 2024

- 12 min read

- Tax & VAT

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Whether you're a seasoned landlord with an established property rental business or dipping your toes into property investment, understanding the tax implications of your rental earnings is crucial. In this comprehensive guide, we'll unravel the complexities surrounding tax on property income, providing you with key information, essential deductions, and step-by-step guidance on calculating your liability. Our mission is to empower you to manage your finances efficiently, ensuring you pay the right amount without missing out on eligible tax-saving opportunities. So, grab a cup of tea, get comfortable, and let's dive into the world of UK rental revenue taxation together.

Key Takeaways

- Rental income includes not only the rent received from tenants but also non-refundable deposits, charges for additional services, and certain utility payments made by the landlord. It is important to accurately determine what counts as taxable income.

- Landlords can reduce their income tax liability by deducting allowable expenses related to property management and maintenance, and they may qualify for the Qualified Business Income Deduction, which allows a deduction of up to 20% of qualified business income.

- It’s essential for landlords to keep accurate records of all rental revenue and expenses, report earnings above the relevant thresholds, and understand the implications of tax credits such as the 20% mortgage interest credit, all of which can significantly impact their tax liability and compliance.

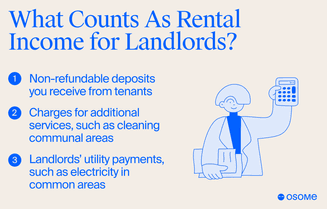

What Counts as Rental Income for Landlords?

Rental income is not just the rent you receive from your tenant on your buy to let property. It encompasses various additional incomes that can significantly affect your tax calculations. Some examples of rental revenue include:

- Non-refundable deposits you receive from tenants

- Charges for additional services, such as cleaning communal areas

- Landlords’ utility payments, such as electricity in common areas

All of these sources of income are considered rental income and should be included in your taxable rental revenue.

Moreover, if a portion of the tenant’s deposit is withheld and not returned, it becomes part of the rental income you must pay tax on. Even income derived from letting furnished properties is included in rental income. Also, remember that adding rental revenue to other income could potentially push you into a higher tax bracket, affecting the rate at which your rental profits are taxed.

How Much Rental Income Do You Pay Tax On?

The amount of income tax from rentals you pay is based on your total income from the buy to let property, which includes rental profits, and this is declared on your Self Assessment tax return, even if you're an overseas property owner. This means that your rental revenue is combined with other sources of income, which could result in a higher tax bracket for you. Because of this, managing rental properties requires thoughtful deliberation. For example, the income tax rates for 2024 in the United Kingdom range from 20% to 45%, depending on your income level.

Landlords can deduct the following expenses related to managing, maintaining, and running the rental property:

- Property management fees

- Maintenance costs

- Insurance premiums

- Homeowners association fees

- Travel expenses related to the rental property

The Qualified Business Income Deduction (QBI) allows landlords to potentially deduct up to 20% of their qualified business income. Note, however, that there are income thresholds and activity requirements to qualify for this deduction. It's also worth knowing that if you're a company paying Corporation Tax, you can claim interest on property loans as an allowable expense.

How To Calculate Tax on Rental Income

Though it might appear complex, calculating the tax on your rental income is actually simpler than it seems, especially when using a reliable rental income tax calculator. The key is to understand what counts as rental income and what counts as an allowable expense. Taxable lease income is calculated by adding all rental income and then subtracting allowable expenses. The income is generally split equally for tax purposes for landlords with properties jointly owned by a spouse or civil partner.

However, if you have a different arrangement that reflects the actual ownership percentages, you can use that instead. Remember that while managing multiple properties, you should combine all rental revenue and allowable expenses to calculate the collective net profit or loss as if operating a single business.

Outsourcing a reliable accounting service like Osome's will assist you in calculating what tax you need to pay during the Self Assessment tax return period.

Rent and other incomes

As we’ve mentioned earlier, rental income isn’t just the rent you receive from your tenants. Other forms of income, such as charges for additional services and payments for utilities provided by the landlord, are also part of lease income. These other incomes can include charges for the cleaning of communal areas, hot water, and heating.

It's important to note that non-refundable deposits from tenants count towards your taxable rental income. Although a tenant's deposit is not initially taxable, any amount that is withheld and not returned to the tenant becomes part of your taxable rental income. Therefore, it's crucial to keep track of all your income sources to calculate your taxes accurately.

Allowable expenses

Just as there are different sources of rental income, there are various types of expenses that can be deducted from lease income for tax purposes. These include:

- Letting agents’ fees

- Insurance premiums

- Maintenance

- Utility bills

- Direct costs of letting the property

Landlords can lower their tax liability by deducting these allowable expenses corresponding to work performed in a specific tax year. You can also check if you're eligible for things like council tax rebates.

Deductible professional and administrative expenses include letting agent fees, accountancy fees, and legal costs related to short-term lets or lease renewals. Costs associated with general maintenance and repairs, such as redecorating, repairing, or replacing broken boilers, are also allowable. However, these expenses must be distinct from capital improvements, which are generally not deductible.

However, if you're a registered company paying Corporation Tax, property loans count as an allowable expanse that you can claim interest on.

When Do I Pay Tax on Rental Income?

Landlords must declare their rental income after the end of the tax year, which runs from April 6th to April 5th of the following year. The deadline for submitting a paper tax return is October 31st. For an online tax return, the deadline is January 31st of the following year. Hence, maintaining your financial records in order and submitting them by these dates is crucial to avoid penalties.

The tax on property rental revenue is due by January 31st online, following the end of the tax year. From 2026, under the Making Tax Digital scheme, landlords must keep digital records and submit quarterly returns in addition to the annual tax return for their rental business. This means if you’re a landlord earning less than £1,000 a year in rental income, you’re not required to pay income tax or report it to HMRC. If you earn rental income between £1,000 and £2,500 a year, contacting HMRC for further guidance is important.

And if your earnings are between £2,500 and £9,999 in a tax year after allowable expenses or over £10,000 before allowable expenses, you must register with HMRC and complete a self assessment tax return annually.

Mortgage Interest Tax Relief for Landlords

If you’re a landlord with a mortgage, there’s good news for you. Landlords can receive a 20% tax credit on the interest they pay on their mortgage. This benefit can help reduce their tax burden and the amount owed on their tax bill. This tax credit is calculated at a flat rate of 20%, which has implications for higher-rate taxpayers who previously could claim up to 40% relief on mortgage expenses.

However, this new system of mortgage interest tax relief can result in landlords being pushed into higher tax brackets, ultimately increasing their tax bill. This is because mortgage interest is no longer deductible from rental income but is instead a tax credit.

Any unused finance costs, which arise when the 20% tax reduction based on finance costs, property business profits, or adjusted total income is less than the actual finance costs, can be carried forward to subsequent years.

Rental Income Tax from Multiple Properties

Managing multiple properties can be a complex task, especially when it comes to calculating lease income tax. All rental income and allowable expenses should be combined to determine the net profit or loss for the collective properties as if they were a single business. This means that you must aggregate all rental income and expenses, regardless of the number of properties you have.

However, if you are interested in a property rental business besides individual rental properties, expenses and receipts from the business cannot be lumped with personal property rental finances. Similarly, joint property ownership with someone other than a spouse or civil partner generally means that rental profits and losses are divided according to each owner’s share. But different arrangements can be made with mutual agreement. Hence, it’s vital to monitor income and expenses for each property separately for precise tax calculations.

What Is the Property Income Allowance?

The property income allowance is a boon for landlords, that exempts them from taxes on the first £1,000 of their rental income each year. This means the first £1,000 of income from property rental is tax-free. However, landlords cannot deduct any other expenses if they claim this property income allowance.

Furthermore, the property income allowance cannot be used to create a tax loss by deducting more than the amount of income earned. And it’s not eligible for use with the Rent a Room Scheme or if finance costs are claimed. Hence, landlords should carefully decide whether to claim the property income allowance or itemise expenses based on their unique circumstances.

Handling Losses and Future Profits

Running a rental business can sometimes result in losses. However, these losses can be offset against future profits from the same property business or carried forward to a later year within the same business. This implies that losses incurred in one tax year can be carried forward to set off against profits in the following years.

No special claim is required to carry forward losses. Still, they must be deducted when calculating the profit for the current year, with any unused loss carried forward indefinitely until fully relieved. However, property business losses can only be offset against profits from the same property business. They cannot be carried forward if the business ceases or if the landlord starts a new property business after an interval.

How To Complete a Tax Return on Rental Income

Though completing a tax return for rental income may seem intimidating initially, the process becomes straightforward once you understand the necessary steps. As a landlord, you must declare your rental income after the end of the tax year, and a tax return is required if your rental income exceeds certain thresholds. To pay income tax on your rental earnings, simply follow the guidelines provided by the tax authorities but ensure you register for self assessment first.

Landlords register for Self Assessment using form SA1, including personal details and the date they began receiving rental income. Once registered for Self Assessment, landlords complete tax returns with their rental income details. Landlords can also use the Let Property Campaign to disclose any undeclared rental income from previous years.

Landlords who recently started receiving rental income should register for Self Assessment by October 5th, following the first tax year they received rental income, to avoid penalties.

Rental Tax Changes for Landlords

For a landlord, keeping abreast of changes in property income tax laws, corporation tax regulations, and other tax-related matters is vital, given their significant impact on tax liabilities and financial planning. Some key changes include the reduction of the Capital Gains Tax (CGT) Annual Exempt Amount and the tax-free dividend allowance for shareholders, which may affect when they need to pay capital gains tax. If you're a commercial property, there are several capital gains tax reliefs available.

Moreover, the Stamp Duty Land Tax (SDLT) nil-rate increase will revert to the original rate in March 2025, prompting considerations for property purchases or business structuring before the deadline.

Starting from April 6, 2026, landlords with income over £50,000 and a higher tax bill will be required to keep digital records and submit updates quarterly under the Making Tax Digital scheme, which may also impact their council tax obligations.

That’s why it’s recommended to employ accountants for up-to-date financial advice and assistance with compliance. Professional accountants like the ones at Osome specialise in maximising deductions, ensuring accurate record-keeping, and keeping a finger on the pulse of ever-evolving tax regulations, allowing landlords to focus on their properties while avoiding compliance pitfalls and optimising their financial outcomes.

Tips for Efficient Record-Keeping and Financial Management

Efficient record-keeping and financial management are key to successful property management. Landlords are required by law to keep meticulous records of rental income and expenses for at least 5 years after the tax return deadline. Even when taking advantage of the property income allowance, landlords must maintain records, and failing to have accurate and complete records can result in penalties from HMRC.

Moreover, creating a comprehensive budget that accounts for all income and expenses gives landlords a clear picture of their property’s financial status. Accurate income forecasting is crucial and should consider current market trends and the potential for rent increases based on national economics and property amenities. Regularly reviewing property expenses helps landlords identify areas of potential savings and ensures that financial reports remain precise and up-to-date.

Property Accountants and Tax Advisors Services

The complexities of income tax from rentals can sometimes become overwhelming, particularly for landlords managing multiple properties or dealing with additional income sources. In such cases, hiring a professional accountant or tax advisor can be extremely beneficial. A tax advisor proficient in:

- Capital Gains Tax

- Stamp Duty

- Inheritance Tax

- The implications of moving properties to a limited company

can provide valuable assistance to landlords, along with support for non-residents or those who have retired abroad.

Accounting services offer peace of mind to landlords by ensuring that rental accounts are kept in order, comply with tax regulations, maximise rental properties' business potential through efficient tax practices, and are well-versed in tax rules and residential property taxation. Therefore, to ensure trustworthiness and reliability in managing their tax affairs, landlords should choose a tax advisor with a strong reputation, positive client reviews, and someone who encourages open communication and trust.

Summary

Navigating the complexities of rental income tax can be a daunting task, but with the right knowledge and strategies, you can optimise your tax position and avoid unnecessary headaches. From understanding what counts as rental income to knowing how to calculate lease income tax and handling losses and future profits, we’ve covered a lot of ground. We’ve also discussed the importance of staying informed about rental tax changes and the benefits of hiring professional help to manage your tax affairs.

In conclusion, being a landlord involves more than just collecting rent. It’s about managing your properties effectively, understanding your tax obligations, and planning your finances strategically. So, equip yourself with the right knowledge, stay informed, and don’t hesitate to seek professional assistance when needed. Remember, the key to successful property management is efficient record-keeping, financial management, and being proactive about your tax obligations.

FAQ

How do I avoid paying taxes on rental income?

To avoid paying income tax on rentals, you can consider options such as assigning a beneficial interest to your spouse, transferring the property to a limited company, and offsetting allowable expenses to reduce the tax bill on rental income. Consider seeking professional advice to determine the best approach for your specific situation.

Do I have to pay tax if I rent to my family?

Yes, you are still liable for tax if you rent to a family member or friend, and any rent received must be declared. If the rent exceeds costs, you may need to pay tax on the excess income.

How does the 20% tax credit work for landlords?

The 20% tax credit for landlords means they can no longer deduct mortgage interest from rental income but receive a 20% tax relief on interest payments instead. This change came into effect in April 2020.

What counts as rental income for landlords?

Rental income for landlords includes rent from tenants, non-refundable deposits, charges for extra services (like cleaning communal areas that fall under Council Tax services), and payments for utilities provided by the landlord.

How do I calculate tax on my rental income?

To calculate tax on your rental income, add all rental income and subtract allowable expenses to determine the taxable rental income.<br>

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?