Side Hustle Tax in the UK: A Comprehensive Guide for Extra Income Earners

- Published: 19 December 2023

- 11 min read

- Tax & VAT

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

Are you looking to make extra cash with a side hustle in the UK? If so, it’s important to understand the tax implications and how to manage your finances effectively. This comprehensive guide will help you navigate the ins and outs of Side Hustle Tax UK and ensure you maximise your earnings every tax year.

Key Takeaways

- Maximise your side hustle income by understanding the UK tax implications and taking advantage of available relief options.

- Stay compliant with HMRC regulations to avoid fines or interest on late payments while balancing employment and self-employment.

- Utilise helpful resources like calculators and finance management apps for accurate calculations and efficient financial control!

Understanding the Tax Implications of Side Hustles in the UK

Starting a side hustle can be exciting, but understanding the tax implications is necessary to stay on the authorities' right side. In the UK, side hustlers are subjected to pay income tax and National Insurance Contributions (NICs), depending on the level of earnings and employment status. Declaring your self-employment income to HM Revenue and Customs (HMRC) is required to maintain compliance and prevent fines and extra interest on overdue payments, regardless of whether it's tax-free.

The UK's income tax on side hustles is based on your combined income from your main job and self-employment. Profits from a side hustle may push you into a higher tax bracket, allowing you to benefit from more tax reliefs. On the other hand, tax on your 9-5 job is deducted from your salary by PAYE, while it’s your responsibility to pay tax on side hustles, giving you the opportunity to take advantage of the tax benefits on your additional income.

Income tax on side hustle earnings

Your self-employment income can push you into higher tax brackets, where you’ll pay more tax, but it can also provide an opportunity to increase your overall earnings. Income tax on side hustles in the UK depends on the combined income from your main job and side hustle, which may help you benefit from higher tax brackets.

To ensure that your self-assessment tax return for your side hustle is complete, include all details of your employment so HMRC has all the information they need to determine how much tax and national insurance you’ve already paid. This will help you accurately calculate the amount of tax you owe and avoid any potential penalties for late or incorrect payments.

National Insurance Contributions (NICs) for side hustles

Besides income tax, UK side hustlers may also be required to pay Class 2 or Class 4 NICs on their supplemental income. These contributions are in addition to NICs deducted from their main job salary, ensuring they meet their obligations. The current rates for Class 2 NICs are £3.15 per week, while Class 4 NICs are 9% on profits between £9,568 and £50,270 per year and 2% on profits above £50,270 per year.

When working out your Tax and National Insurance Contributions for UK side hustles, consider the profits from your side job. If regarded as self-employment, you must pay Class 2 and Class 4 NICs. Class 2 contributions are a flat rate per week, while Class 4 contributions are a percentage of your profits. Find the specific rates and thresholds for Class 2 and Class 4 contributions on the HMRC website to ensure you pay the correct amount.

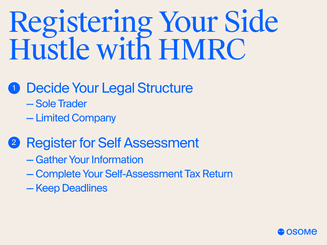

Registering Your Side Hustle with HMRC

Registering your side hustle with HMRC is vital to maintain legal compliance and maximise the fruits of your labour (you deserve it, after all!). The process involves two main steps: choosing a business structure, such as a sole trader or limited company, and registering for self-assessment.

Creating a legal structure is the best way to get started with your side hustle. Setting yourself up as a sole trader or limited company can help you streamline the process and manage your side hustle effectively. Before 5 October each year, ensure you register as self-employed with HMRC to stay compliant and avoid fines and added interest on late payments.

Choosing a business structure

Choosing a suitable business structure for your side hustle is significant for both legal and tax reasons. Sole trader registration is the most common choice for side hustles, as it offers the simplest and most straightforward setup and management process.

Before deciding on the best business structure for your side hustle, consider investing time in research or seeking expert advice. Different business structures have varying tax implications and legal responsibilities, so it’s essential to understand which structure best suits your side hustle’s needs and requirements so you can pay tax efficiently within each tax year.

Registering for Self-Assessment

Registration for Self-Assessment with HMRC is required to declare your second income and remit the appropriate amount of tax. You can easily register by providing your full name, national insurance number, and current address. Once registered, you will receive a Unique Taxpayer Reference (UTR) to submit your tax return.

It’s essential to complete your Self-Assessment tax return annually, with a deadline of 31 January each tax year. Failure to register or submit your tax return on time can result in financial penalties and backdated tax payments. Stay on top of your side hustle finances by registering for Self-Assessment and submitting your tax return promptly.

Managing Your Side Hustle Finances

Efficient management of your side hustle finances requires claiming eligible expenses to diminish taxable profit and setting aside money for tax payments year-round. By keeping accurate records of your trading income and related expenses, you can maximise your financial potential and stay compliant with tax obligations.

Remember that claiming allowable expenses for side hustle costs, such as materials, website fees, and travel expenses, can help lower your tax bill and maximise your income. Be sure to keep your side hustle finances separate from your personal finances to ensure accurate tax reporting and avoid potential penalties for late or incorrect tax payments.

Claiming allowable expenses

Permissible expenses for UK side hustles encompass operating costs like stationary, software, telephone bills, and other expenses related to the business. You can also deduct expenses like property rent, mortgage interest, council tax, business rates, water rates, electricity, and gas. Claiming these expenses can help lower your taxable profit and reduce your tax bill.

To claim allowable expenses for your side hustle, follow these steps:

- Confirm that your side hustle qualifies as self-employment.

- Carefully record all your business expenses, ensuring they are solely for business purposes.

- Identify which expenses are allowable by HMRC.

- Include these allowable expenses in your self-assessment tax return.

- Calculate the total amount of allowable expenses and deduct them from your income to reduce your tax bill.

Budgeting for tax payments

Reserving a part of your side hustle revenue for paying tax and operating a separate bank account for managing side hustle finances can aid in organisation and ensure timely and complete tax payments. This also makes it easier to track your earnings and expenses related to your side hustle and stay compliant with tax obligations.

Using a separate bank account for managing side hustle finances offers numerous benefits, such as:

- Better organisation

- Improved financial control

- Added professionalism

- Simplified bookkeeping

By keeping your side hustle finances separate from your personal finances, you can accurately calculate how much tax you need to pay, report your taxes and avoid potential penalties for late or incorrect tax payments.

How To Complete Your Self-Assessment Tax Return

Filling out a Self-Assessment tax return requires declaring side hustle income, claiming tax relief, and submitting the return by the yearly deadline. The trading allowance for self-employed income is £1,000, which allows individuals to earn up to this amount per tax year from trading, casual, or miscellaneous income without paying tax or National Insurance. To determine how much income tax you need to pay, consider any income above this allowance.

Exactly how much tax you must pay on your side job income is required. Consider national insurance and income tax, and consult with HMRC or use a side hustle pay calculator to determine the specific tax obligations based on your income. By staying on top of your side hustle finances and submitting your Self-Assessment tax return on time, you can avoid potential penalties for late or incorrect tax payments.

Reporting side hustle income

When declaring side job income on your Self-Assessment tax return, make sure to include all income, even if it’s less than the £1,000 trading allowance. Even if your additional income is tax-free, it’s important to declare it to HMRC to stay compliant and avoid fines and added interest on late payments.

Consider each job separately when calculating your taxable income in the case of multiple gig jobs. Each gig should be calculated individually and reported accordingly to ensure accuracy. By accurately reporting your second income, you can effectively calculate the amount of tax you owe each tax year and avoid potential penalties for late or incorrect payments.

Tax relief options

A variety of tax relief options exist for UK side hustlers, like the tax-free trading allowance or the tax-free allowance option to claim actual expenses. The trading allowance allows you to offset up to £1,000 of your income against your tax bill. If your total expenses are lower than the trading allowance, you can use this allowance to minimise your tax liability.

However, if your expenses exceed the trading allowance, you may benefit more from claiming actual expenses instead. By claiming all allowable expenses related to your side hustle, you can further reduce your taxable profit and potentially lower your tax bill if you pay income tax. Be sure to explore all the options and choose the one that benefits your side hustle finances most.

Balancing Employment and Self-Employment

Juggling employment and self-employment may pose challenges, but both can be effectively managed with an appropriate strategy. It’s important to consider the legal implications, such as potential conflicts of interest, and manage your time effectively to ensure success in both your main job and side hustle. It's important you also stay on top of your invoicing to get paid on time and have this process streamlined.

Review your employment contracts carefully to ensure you are not breaching legal obligations with your side hustle. By staying compliant with your primary employment and managing your side hustle effectively, you can maximise your earning potential and enjoy the exciting opportunities available for side hustles in the UK.

Legal considerations

Before starting a side hustle, review your employment contract for any exclusivity clauses or restrictions that might hinder your ability to initiate a side hustle. These clauses may include:

- Non-compete clauses

- Exclusivity clauses

- Confidentiality clauses

- Intellectual property clauses

All of these could potentially impact your side hustle activities.

To avoid conflicts of interest between your main job and side hustle, follow these steps:

- Communicate with your employer about your secondary employment.

- Ensure any potential competing interests are managed properly.

- Be transparent with your employer and address any potential conflicts.

- Following these steps, you can maintain a healthy balance between your main job and side hustle.

Time management tips

Effective time management is key to balancing the demands of your regular job and side hustle. Develop time management strategies, such as setting specific work hours and prioritising tasks, to ensure success in both areas.

Consider using time-tracking tools, such as:

- Toggl Track

- HourStack

- TimeCamp

- Buddy Punch

These tools can help you track your time on your side hustle and manage projects efficiently. By staying organised and managing your time effectively, you can successfully balance your main job and side hustle, maximising your potential earnings and enjoying the benefits of both employment and self-employment.

Side Hustle Tax Calculator and Resources

Use side hustle tax calculators and resources to gauge payments when paying tax, comprehend implications when you pay tax and effectively manage your side hustle finances. HMRC's second job tax calculator can help you accurately calculate how much tax you need to pay on your side hustle, ensuring you stay on top of your finances and pay the right amount each tax year.

Additionally, consider using finance management apps, such as:

- YNAB

- Goodbudget

- EveryDollar

- Zeta

- Rocket Money

- PocketGuard

- Honeydue

- Wally

- Buddy

- Simplifi

These apps can help you track your self-employed income and expenses, stay organised, and comply with tax obligations. You can make the most of your side hustle earnings by leveraging these resources.

Summary

In conclusion, understanding side hustle tax in the UK is essential for maximising your earnings and staying compliant with tax obligations. From registering your side hustle with HMRC and claiming allowable expenses to balancing employment and self-employment, this comprehensive guide has provided the knowledge and resources you need to succeed in your side hustle journey. With the right approach and a clear understanding of your tax obligations, you can maximise your side hustle and enjoy its exciting financial opportunities.

FAQ

Is HMRC cracking down on side hustles?

HMRC is cracking down on side hustles with new data-sharing rules that will come into effect from 1 January 2024, requiring platforms such as Etsy, Airbnb, Deliveroo, Uber, Upwork and Fiverr to share user's income information.

Will HMRC know about my side hustle?

HMRC will be able to check the details of your side hustle when you register your business and declare profits through an annual self-assessment every January. In addition, from 1 January 2024, websites and apps facilitating side hustles must share user details with the taxman, including bank account details. Therefore, HMRC is likely to know about your side hustle.

What is the HMRC side hustle rule for January 2024?

Starting January 1, 2024, HMRC is rolling out a new side hustle rule that requires freelancer platforms to report their users' earnings to the tax office. Prepare to declare your income and pay tax according to your earnings come January! And ensure you're organised when it comes to paying tax each tax year.

Do I need to pay taxes on side hustle income in the UK?

Yes, you need to pay taxes on self-employment income in the UK. Don't forget to include it on your tax return, even if it's below the tax-free trading allowance.

How do I register my side hustle with HMRC?

Take the first step to make your side hustle official by choosing a business structure and registering for self-assessment with HMRC. Start today and watch your hustle grow!

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?