Top Allowable Expenses for Landlords: Maximise Your Rental Returns in 2024

- Published: 16 May 2024

- 8 min read

- Grow Your Business

Gabi Bellairs-Lombard

Business Writer

Gabi is a content writer who is passionate about creating content that inspires. Her work history lies in writing compelling website copy, now specialising in product marketing copy. Gabi's priority when writing content is ensuring that the words make an impact on the readers. For Osome, she is the voice of our products and features. You'll find her making complex business finance and accounting topics easy to understand for entrepreneurs and small business owners.

As a landlord in the UK, calculating your income tax involves a specific set of considerations that are different from that of regular taxpayers. Your income tax bill for any given tax year will first involve calculating your total rental income and determining the expenses you can deduct from your property income.

Are you a private residential landlord, or do you have commercial properties that are let out? Are you seeking clarity on what expenses are allowed for landlords?

Understanding which costs are deductible on your tax return is essential for reducing your taxable rental income and maximising your profits. These expenses are varied but cover any cost that has been incurred solely from renting out your property. Dive in as we outline what qualifies, the common pitfalls to avoid, and the strategic advantages of optimising your claims.

Key Takeaways

- Allowable expenses in the context of landlords are costs wholly and exclusively incurred from renting out property, which can be deducted from rental income to lower the taxable profit and ultimately reduce the tax bill.

- There are many allowable expenses, such as finance costs, property management company costs and repairs, insurance premiums, council tax, and administrative fees. Each allowable expense helps to maximise rental returns and claim tax relief.

- It is crucial to differentiate between capital expenditures (not deductible) and revenue expenses (deductible), as well as to maintain accurate records and report taxable profits to HMRC to ensure compliance and avoid penalties.

Understanding What Constitutes an Allowable Expense for Landlords

Envision being able to deduct certain expenses incurred from your rental property directly from your rental income. This isn't a fantasy, but the concept of 'allowable' or an expense that can be deducted from your income for tax purposes.

These expenses arise solely and exclusively from the process of renting out your property. Comprehending and claiming these expenses can help lower your tax burden, thereby optimising your net profit from a rental property.

Intrigued? Allow us to explore further.

What is an allowable expense?

Allowable expenses refer to business costs that can be subtracted from your income to determine your overall profit for tax purposes. These expenses are a great help in reducing taxable income. These are costs that are wholly and exclusively incurred for the purpose of renting out property. Some examples of such expenses include:

- General maintenance

- Utility costs

- Insurance

- Letting agent fees

These expenses can be deducted from your rental income.

Gaining a good grasp of what constitutes an allowable expense is vital so you don't miss any potential deductions when you claim them.

The significance of claiming an allowable expense

Claiming an allowable expense is more than just a matter of compliance; it's a strategic financial move. When you claim these expenses, you effectively decrease the amount of your taxable rental profit. And a lower taxable rental profit means a reduced tax bill. This can significantly enhance your after-tax returns, making a considerable impact on your overall rental income.

Thus, comprehending and learning how to claim allowable expenses can be a significant advantage for private residential landlords.

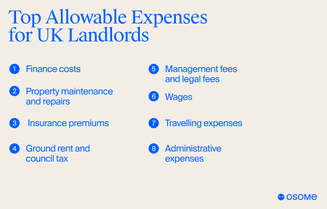

Top Allowable Expenses for UK Landlords

Having grasped the concept and importance of an allowable expense, we can now delve into the specifics. Some of the top landlord allowable expenses include:

- Finance costs

- Property maintenance and repairs

- Insurance premiums

- Ground rents and service costs

- Council tax

- Management fees and legal fees

- Wages

- Travelling expenses

- Administrative expenses

- Only the interest element of any mortgage or mortgage arrangement fees

- Any other finance costs related to the property rented out

Each of these expenses, when handled correctly, can contribute to maximising your rental returns.

Finance costs

According to the Capital Gains Tax Bill, landlords in the UK are subject to CGT when they sell a rental property that has increased in capital value since its purchase. However, you can claim capital expenses or capital allowances incurred during the ownership of the property. These expenses can be deducted from the gain, reducing the amount of CGT owed.

This is important when considering finance costs as expenses that can be deducted from your tax bill. Finance costs typically include those associated with purchasing and maintaining your property. The interest on loans and mortgages is part of these finance costs, and although they are restricted, they can be claimed too and used to lower your capital gains liability.

For example, if you raise your mortgage loan on your buy-to-let property, the mortgage interest on the additional loan can be considered a revenue expense and claimed correspondingly, potentially reducing your capital gains tax liability.

Property maintenance and repairs

Another crucial category is property maintenance and repairs. These include general repairs, such as fixing leaking pipes, repairing electrical faults, and repairing appliances. Redecorating costs, including painting, re-plastering walls, and replacing flooring, are also considered maintenance expenses and can be deducted from your rental income.

However, it's important to remember that the value of like-for-like replacements cannot be superior when claimed as allowable expenses.

Insurance premiums

Insurance premiums also fall under the list of tax-deductible expenses for landlords. These include building and contents insurance, as well as landlord insurance, which offers liability protection and loss of rent coverage. By deducting these premiums, you can significantly lower the amount of tax you owe to the government.

Ground rent and council tax

If you bear the responsibility of paying ground rent or paying council tax for your buy-to-let properties, these can be claimed as tax-deductible expenses. If tenants cover these costs, you can still claim expenses for periods when the rental property is unoccupied. It's an area that is often overlooked but can significantly contribute to reducing your tax liability.

Management fees and legal fees

Management and legal fees are also included in the ambit of allowable expenses. These include:

- Fees for the renewal of a lease

- Shorthold tenancy fees

- Eviction procedure fees

- Rent collection fees

- Accountancy fees

However, it's worth noting that legal expenses for the initial letting of a property or for letting agreements that last more than a year are not allowable expenses.

Wages

An often overlooked aspect is that wages for property-related employees can also be claimed as allowable costs. For instance, you can deduct the wages of gardeners and cleaners from your rental income when calculating your taxable rental profit.

Travelling expenses

Travel expenses arising out of business purposes related to your rental property, such as inspections or tenant meetings, can be claimed. However, the rules around claiming travel expenses are quite specific.

For example, you cannot claim the cost of travelling from home to an office if the rental business is not run from home as that classifies as personal expenses, but you can claim travel from the office to the rental property.

Administrative expenses

Administrative expenses, encompassing personal costs such as postage, stationery, and phone calls, among others, can also be deducted.

Costs for advertising for new tenants, whether online or offline, can be deducted as well.

Service charges

In the UK, service charge costs that have been incurred by landlords in relation to their rental properties can be claimed too, provided that the expense is relevant or 'service charges direct costs' to the rental property in question.

Other expenses

Lastly, expenses incurred wholly for the property business can also be claimed. One example of a deductible expense for landlords is the licence fee for Houses of Multiple Occupation (HMO). This expense can be claimed as a part of the property costs on your tax return.

Claiming Relief for Domestic Items Replacement

Let's now turn our attention to the Replacement of Domestic Items Relief, a form of tax relief for landlords. As a landlord, you can claim this relief for the cost of replacing domestic items in your properties. This can be a significant saving, especially given the wear and tear on these items over time.

What qualifies for the relief?

So, what qualifies for this relief? The relief applies to domestic items commonly used within a dwelling-house for tenants. This includes:

- Moveable furniture

- Furnishings

- Household appliances

- Kitchenware

- Televisions

However, to qualify for the relief, the replaced domestic items must be like-for-like replacements of the old items.

How to claim the relief

Making a claim for this relief is a straightforward process. All you need to do is deduct the cost of the replacement item from your rental income. But remember, you need to subtract any proceeds from the sale of the old item and any disposal costs.

Capital Expenditure Vs. Revenue Expense

Let's now explore another crucial distinction - the difference between capital expenditure and revenue expense. While both are expenses for your rental property, they differ in their nature and how they are treated for tax purposes.

What is a capital expense?

Capital expenses typically involve the enhancement of the property through alteration or improvement, like enlarging a driveway. It also includes property improvements and initial refurbishments before letting out the property. However, these costs are not deductible from rental income.

What is revenue expense?

On the other hand, revenue expenses relate to the costs that are incurred from day-to-day rental operations. These include interest on loans, arrangement fees, and bank charges on rental property bank accounts. While finance costs are a form of revenue expense, for most residential properties, there is a restriction allowing only 20% of costs incurred to be claimed against tax liability.

Record Keeping and Reporting Taxable Profits

As we conclude our exploration of expenses, let's consider two very important aspects - maintaining records and reporting taxable profits. While it may not seem directly related to expenses, these are crucial for compliance and avoiding penalties when you pay tax.

The significance of proper record-keeping

Accurate and complete records are a must for any landlord. You are required to maintain records of rental income and expenses for a minimum of five years after the tax return deadline. This is crucial not only for your personal comprehension and monitoring of your rental business but also for adhering to HMRC requirements.

Reporting taxable profits to HMRC

Communicating your rental income to HMRC isn't merely a requirement; it's a fundamental aspect of managing the finances of your rental business. It is important to register for Self Assessment by 5 October after the tax year in which you earned rental income. This will ensure compliance with tax regulations. Depending on your circumstances, you may choose to file tax returns using either the cash basis or the accrual basis.

Summary

We've covered a lot of ground in this blog post. We've explored the concept of allowable expenses that can be deducted, the various types of expenses that landlords can claim, the importance of record keeping and reporting to HMRC, and so much more. The key takeaway is that understanding and managing your expenses can significantly impact your rental returns. By leveraging these insights, you can position yourself for greater profitability and success in your rental or property business.

If you're a property business owner or a landlord of a residential property in the UK, Osome can simplify the process of filing taxes and staying compliant for you. With Osome, you can get a personal accountant for your property rental business from day one. Free yourself from the stress of managing your taxes. Our dedicated experts and easy-to-use tools can make everything easy and smooth. Contact us today.

FAQ

What are expenses that can be deducted?

Expenses that are allowable or deductible are business costs that can be deducted from your income when calculating profits for tax purposes, and they must be solely and exclusively related to renting out property.

What is the Replacement of Domestic Items Relief?

Landlords can claim Replacement of Domestic Items Relief for the cost of replacing moveable furniture, household appliances, and other domestic items in rental properties. It covers items like kitchenware and televisions.

What is the difference between capital expense or expenditure and revenue expense?

The main difference between a capital expense or expenditure and revenue expense is that capital expenditure enhances the property, while revenue expenses are incurred from day-to-day operations. Capital expenses typically involve alteration or improvement, whereas revenue expenses are the costs related to rental operations.

How long should I keep records of rental income and expenses?

You should keep records of rental income and expenses for at least five years after the tax return deadline. This will ensure that you have the necessary documentation in case of a tax audit.

How do I report my rental income to HMRC?

To report your rental income to HMRC, you should register for Self Assessment by 5 October after the tax year in which you received the income and choose either the cash basis or the accrual basis for submitting your tax returns.

Can I claim expenses on furnished holiday lettings?

Yes, expenses related to furnished holiday lets, just like other residential properties, are eligible for tax relief.

Get expert tips and business insights

By clicking, you agree to our Terms & Conditions, Privacy and Data Protection PolicyWe’re using cookies! What does it mean?